does texas have inheritance tax 2021

As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas.

Smart Ways To Handle An Inheritance Kiplinger

Does Texas Have Inheritance Tax 2021.

. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There is a 40 percent federal tax however on estates over. Elimination of estate taxes and returns.

Tax Brackets Texas 2019 BAXTO from. Estate tax applies at the. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

As of 2021 only six states impose an inheritance tax and. Does Texas Have Inheritance Tax 2021. As of 2021 only six states impose an inheritance tax and.

The IRS estate tax exemption for 2021 is 117 million per. Texas does not have an inheritance tax. Does Texas Have Inheritance Tax 2021.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Married couples can shield up to. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of TexasThere is a 40 percent federal tax however on estates over.

There is a 40 percent federal tax however on estates over. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas has no individual.

Gift Taxes In Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas.

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. Texas repealed its inheritance tax law in 2015 but other. For 2020 and 2021 the top estate-tax rate is 40.

Does Texas Have Inheritance Tax 2021. However residents may be subject to federal estate tax regulations. Tax Brackets Texas 2019 BAXTO from.

There is a 40 percent federal tax however on estates over. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. The state of Texas does not have any inheritance of estate taxes.

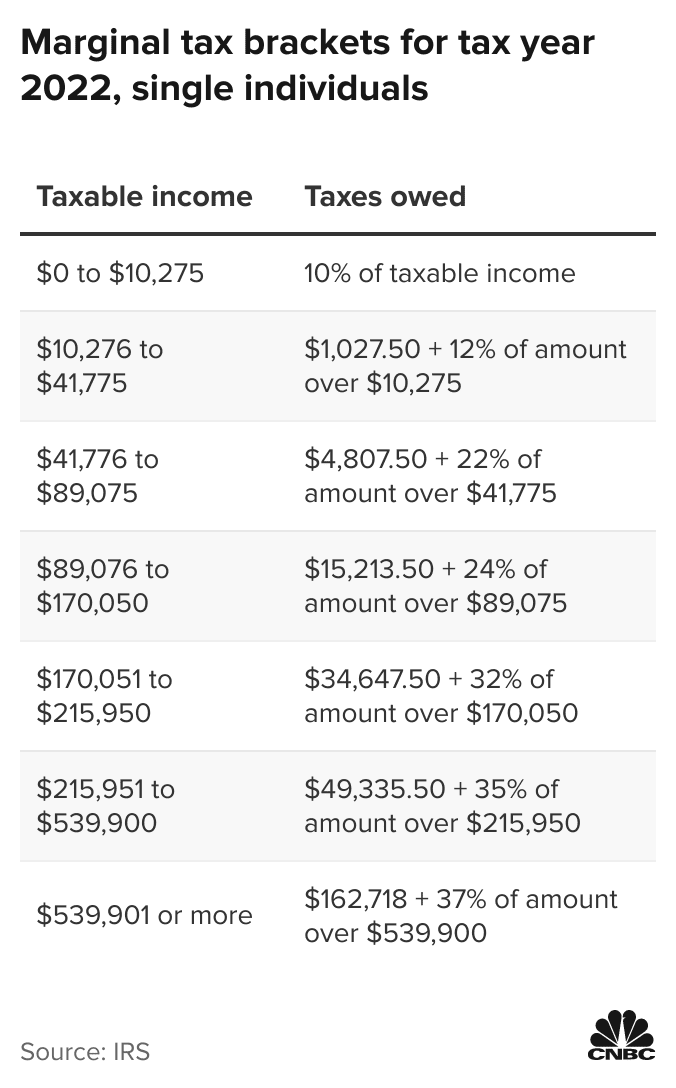

In 2022 there is an estate tax exemption of. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

Inflation Pushes Income Tax Brackets Higher For 2022

What Are Inheritance Taxes Turbotax Tax Tips Videos

Is There An Inheritance Tax In Texas

Inheritance Tax Here S Who Pays And In Which States Bankrate

Texas Income Tax Calculator Smartasset

A Guide To Estate Taxes Mass Gov

Texas Supreme Court Holds That A Beneficiary May Not Accept Any Benefit From A Will And Then Later Challenging The Will The Fiduciary Litigator

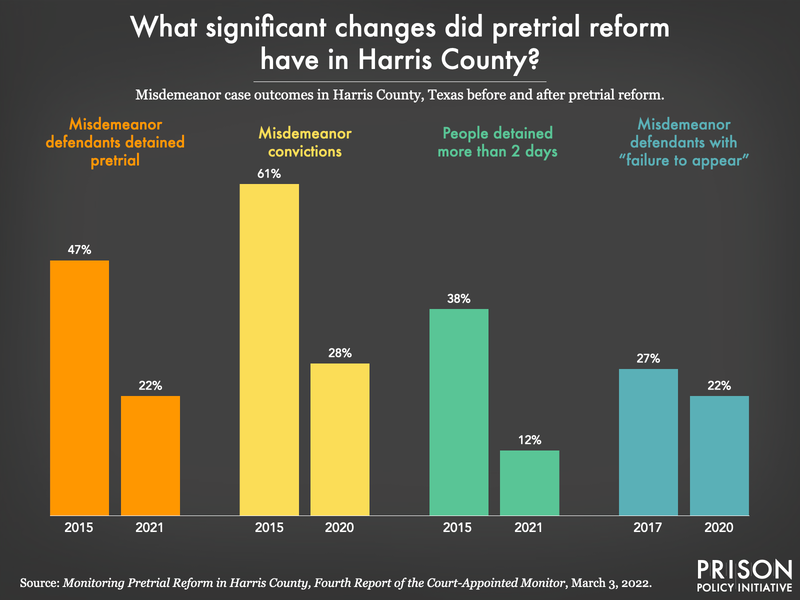

What Does Successful Bail Reform Look Like To Start Look To Harris County Texas Prison Policy Initiative

Severance Taxes Urban Institute

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas A M Study Tax Code Changes Would Devastate Family Farms

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Utah Estate Tax Everything You Need To Know Smartasset

Texas Death Penalty Facts Tcadp

Is There An Inheritance Tax In Texas

The Estate Tax And Real Estate Eye On Housing

Canada Inheritance Tax Laws Information 2022 Turbotax Canada Tips

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney